This Google Chrome extension simplifies the creation of real estate sales contracts, provides on-demand research tools, and calculates maximum allowable offers. It integrates with popular data portals and generates PDF contracts instantly.

iBuyAny.com (buying houses)

All the tools you need to grow in one place: Online Reviews, Messaging, Webchat, Payments, Missed Call Text Back, CRM

Andre Bowdry, principal at iBuyAny, LLC is a Licensed Real Estate Brokers (in the state of Illinois), and is a Real Estate Investor for over 30 years (Please note a 1991 Chicago Tribune newspaper article, “BARGAIN HUNTING”, that references our company, formally known as KaNia Enterprises).

(Chicago Tribune Article, transcript)

BARGAIN HUNTING

THERE ARE DEALS TO BE MADE ON DISTRESSED PROPERTIES,

BUT YOU`LL HAVE TO DO SOME LEGWORK

Pamela Sherrod.

Friday, August 2, 1991

Chicago Tribune

If you thought buying mortgage-delinquent property would be a sure-fire way to get rich quick, forget it.

Shopping for distressed properties has the same potential pitfalls as shopping for any kind of bargain: There are good deals to be had for little money, but you have to look for them-and should realize that you could be buying damaged goods.

Like most clearance-sale items, foreclosed property is sold “as is,” and it usually falls into one of two categories: “lemons” or “diamonds in the rough”.

Like the properties, the shoppers usually fall into one of two categories, too. They`re either individuals looking for a place to live for little money or investors looking for properties to resell quickly at a profit.

But some real estate professionals say the cost of repairs on these properties can eat up much of the profit these bargain hunters expect to make. “Even after doing your homework, you can still get stuck with something that will be too expensive to restore to livable standards or something you`ll have trouble unloading later,” said Harold Levine, a Chicago-based attorney who specializes in foreclosed properties.

Buying a house in the most ideal circumstances is risky enough, but purchasing a foreclosed home can be even riskier because the circumstances leading to the foreclosure are anything but ideal.

“When people fall behind on their mortgage, they fall behind in the upkeep of the house, too,” Levine said. “Homes that are not (being foreclosed upon) may need work, but the repairs needed in mortgage-delinquent properties are usually more extensive.” As a buyer interested in purchasing a foreclosed property, you should shop for a house in much the same way you would shop for any home. But you should also take the extra step of finding out as much as you can about the condition of the home and the neighborhood`s property values.

“The auction or sale itself goes by very quickly,” said Antoinette Nasca, office manager of the Intercounty Judicial Sales Corp., 120 W. Madison St., which conducts sales of distressed properties. “It lasts no more than 15 to 30 minutes.” The longest part of these purchases should come well before the auction, when potential bidders bone up on the available properties, she advised. “It`s best to make a bid based on what they feel the property is worth as is and the amount owed the lender.

“You really can`t afford to skimp on any part of this process before making the bid.” Do some snooping One of the first things to find out is how the property got to the sale in the first place.

Properties reach the rosters of distressed real estate sales when the homeowners are in arrears on mortgage payments and unable to work out new payment plans with mortgage lenders. Unemployment, divorce or the death of a spouse often leave homeowners financially strapped and facing foreclosure.

The foreclosure process can take nine months to a year to complete, and the sale or auction of the property represents the end of what is usually a long, bumpy road for the lender and the borrower.

In Cook County, mortgage-delinquent property comes up for public sale after a judgment of foreclosure is filed with the Chancery Division of Cook County Circuit Court. Under foreclosure law, there is a redemption period in which the property can be repurchased by the borrower. The length of the redemption period varies, depending on how long the borrower has held the property.

If the borrower is unable to buy back the property or reinstate the mortgage loan, the public sale takes place 90 days after the court makes a decree of foreclosure.

The lender then decides whether the sale of the property will be handled by the county sheriff`s office or by an independent auction company, such as Intercounty Judicial Sales Corp. or Dunning Auction Service of Elgin, which specialize in selling such real estate.

Getting your hands on lists Periodic listings of mortgage-delinquent properties are printed in the Daily Law Bulletin, which is available at newsstands, and in daily and community newspapers. Those interested in bidding on properties can also get a list in advance of scheduled sales from the auction companies and from the Cook County Sheriff`s Office in the Daley Center.

A list of properties can also be obtained from the real-estate-owned, or REO, divisions of some savings and loans and banks.

Other services, such as KaNia Foreclosure Enterprises in Downers Grove, list properties and background information on them for a fee. These listings include the name of the mortgage company, bank or private individual holding the delinquent note; the name of the borrower; the address of the property; the chancery court case number; the attorneys involved; the mortgage balance; and other notes and descriptions of the property.

Services such as KaNia do some of the homework for bidders, but they also charge a fee; KaNia`s fees range from $30 to $140, depending on the length of time a person has subscribed to the service.

Many who subscribe to these services are investors who make a living by buying and reselling mortgage-delinquent properties for a profit. But people interested in buying a home for themselves can also subscribe.

“Not everyone who comes (to the auction) is a shark,” said Andre Bowdry, who heads KaNia Foreclosure Enterprises and buys mortgage-delinquent properties. “Some people are here to buy homes to live in or to be used as an investment.” Buyers who do their homework can definitely come out ahead, he said.

Pointing to an address on a mortgage-delinquent property list, Bowdry said the single-family home, located in a middle-class South Side neighborhood, could get a bid of $38,000.

“Homes in this block could sell for $80,000,” he said. “Even if you have to put in $10,000 worth of work, you can come out ahead.” Informal affairs The Cook County Sheriff`s Office conducts auctions/sales at noon every Tuesday, Wednesday and Thursday in the seventh-floor hallway at the Daley Center.

These are very informal affairs, usually attended by 25 to 30 people.

Bidders come prepared with lists of the properties and make notes as the bidding progresses.

They also come with cash-a certified check for the full amount they plan to bid made payable to themselves. If the bid is accepted, the certified check is then signed over to the mortgage lender.

Experts keep repeating, however, that bidders should try to see the property before bidding on it.

Scott Bowers, vice president of the real estate division at the Dunning Auction Service of Elgin, says it`s a good idea to bring a home inspector with you to check out the property. Still, you may not be able to enter the house if delinquent homeowners are still living on the premises because they are not required by law to allow bidders onto the property, Bowers said. When this happens, potential buyers often don`t see the interior of the house until the borrower has been evicted by the lender.

“You`d be surprised how many people buy properties without seeing the inside,” Levine said. “No, it`s not wise, but it does happen. Some people are so anxious to get what they think is a deal, they buy without seeing the whole thing.” In addition to checking out the physical aspects of the house, Levine said, bidders should also examine the title to the property.

“This is not a job for novices,” said Levine. “An attorney should help you through the process.” He said it`s also important to obtain a title report on the property and to determine whether there are any liens or other mortgages on it.

Far and wide And while most people may think mortgage-delinquent properties are confined to poor neighborhoods, that`s not the case.

“The addresses are all over the place,” said Nasca. “Rich people get overextended, lose jobs, husbands and their houses like anybody else.” Properties sold at the sheriff`s auction last month included a house at 76th Street and Luella Avenue on Chicago`s South Side, which went for about $38,000; and a condo at 950 N. Michigan Ave., on which a $750,000 bid was made by an attorney representing the delinquent owner/borrower.

“For the most part, these things are attended by the same people, some individual investors, tax guys and lawyers,” said Levine. “Some people have made their living off buying and reselling these properties. The ones who do well at this are the ones who have been doing it for some time. You don`t just come in one day and get rich from buying a couple of these houses.” Investors in delinquent properties, like Bowdry of KaNia Foreclosure, say it`s possible to purchase mortgage-delinquent property before the public sale by contacting the REO department of the mortgage lender. If the lender is willing to share information about the property and sees that the bidder is serious about purchasing it, then the lender may be willing to negotiate a price and financing for the property.

The delinquent borrower/homeowner may also be willing to work out an arrangement with a buyer.

“The homeowners are skeptical in the beginning. They have a hard time coming to terms with what`s happening to them,” said Bowdry, who suggested offering homeowners a few thousand dollars more than what is owed on the property. “This way the homeowner doesn`t lose, the lender is paid and you can get a good buy on a piece of property to use as your own home or as an investment.”

Caption:

PHOTOS 2 GRAPHIC

Caption:

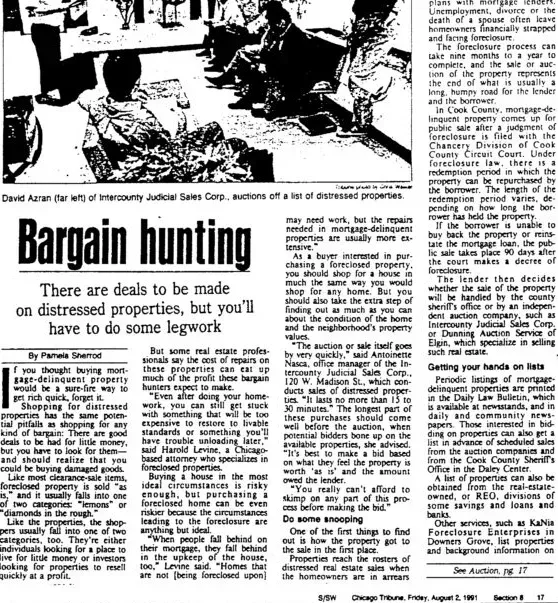

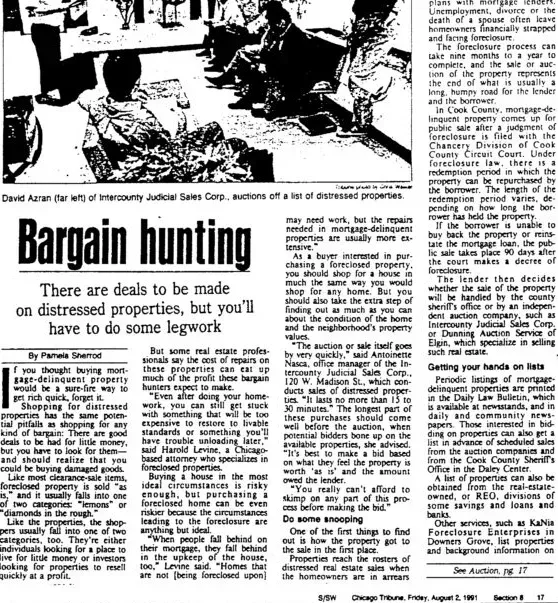

PHOTO: David Azran (far left) of Intercounty Judicial Sales Corp., auctions off a list of distressed properties. Tribune photo by Chris Walker.

PHOTO: A distressed condo in this building, at 950 N. Michigan Ave., went for $750,000 at the sheriff`s auction last month. Tribune photo by Val Mazzenga.

This Google Chrome extension simplifies the creation of real estate sales contracts, provides on-demand research tools, and calculates maximum allowable offers. It integrates with popular data portals and generates PDF contracts instantly.

iBuyAny.com (buying houses)

All the tools you need to grow in one place: Online Reviews, Messaging, Webchat, Payments, Missed Call Text Back, CRM

Andre Bowdry, principal at iBuyAny, LLC is a Licensed Real Estate Brokers (in the state of Illinois), and is a Real Estate Investor for over 30 years (Please note a 1991 Chicago Tribune newspaper article, “BARGAIN HUNTING”, that references our company, formally known as KaNia Enterprises).

(Chicago Tribune Article, transcript)

BARGAIN HUNTING

THERE ARE DEALS TO BE MADE ON DISTRESSED PROPERTIES,

BUT YOU`LL HAVE TO DO SOME LEGWORK

Pamela Sherrod.

Friday, August 2, 1991

Chicago Tribune

If you thought buying mortgage-delinquent property would be a sure-fire way to get rich quick, forget it.

Shopping for distressed properties has the same potential pitfalls as shopping for any kind of bargain: There are good deals to be had for little money, but you have to look for them-and should realize that you could be buying damaged goods.

Like most clearance-sale items, foreclosed property is sold “as is,” and it usually falls into one of two categories: “lemons” or “diamonds in the rough”.

Like the properties, the shoppers usually fall into one of two categories, too. They`re either individuals looking for a place to live for little money or investors looking for properties to resell quickly at a profit.

But some real estate professionals say the cost of repairs on these properties can eat up much of the profit these bargain hunters expect to make. “Even after doing your homework, you can still get stuck with something that will be too expensive to restore to livable standards or something you`ll have trouble unloading later,” said Harold Levine, a Chicago-based attorney who specializes in foreclosed properties.

Buying a house in the most ideal circumstances is risky enough, but purchasing a foreclosed home can be even riskier because the circumstances leading to the foreclosure are anything but ideal.

“When people fall behind on their mortgage, they fall behind in the upkeep of the house, too,” Levine said. “Homes that are not (being foreclosed upon) may need work, but the repairs needed in mortgage-delinquent properties are usually more extensive.” As a buyer interested in purchasing a foreclosed property, you should shop for a house in much the same way you would shop for any home. But you should also take the extra step of finding out as much as you can about the condition of the home and the neighborhood`s property values.

“The auction or sale itself goes by very quickly,” said Antoinette Nasca, office manager of the Intercounty Judicial Sales Corp., 120 W. Madison St., which conducts sales of distressed properties. “It lasts no more than 15 to 30 minutes.” The longest part of these purchases should come well before the auction, when potential bidders bone up on the available properties, she advised. “It`s best to make a bid based on what they feel the property is worth as is and the amount owed the lender.

“You really can`t afford to skimp on any part of this process before making the bid.” Do some snooping One of the first things to find out is how the property got to the sale in the first place.

Properties reach the rosters of distressed real estate sales when the homeowners are in arrears on mortgage payments and unable to work out new payment plans with mortgage lenders. Unemployment, divorce or the death of a spouse often leave homeowners financially strapped and facing foreclosure.

The foreclosure process can take nine months to a year to complete, and the sale or auction of the property represents the end of what is usually a long, bumpy road for the lender and the borrower.

In Cook County, mortgage-delinquent property comes up for public sale after a judgment of foreclosure is filed with the Chancery Division of Cook County Circuit Court. Under foreclosure law, there is a redemption period in which the property can be repurchased by the borrower. The length of the redemption period varies, depending on how long the borrower has held the property.

If the borrower is unable to buy back the property or reinstate the mortgage loan, the public sale takes place 90 days after the court makes a decree of foreclosure.

The lender then decides whether the sale of the property will be handled by the county sheriff`s office or by an independent auction company, such as Intercounty Judicial Sales Corp. or Dunning Auction Service of Elgin, which specialize in selling such real estate.

Getting your hands on lists Periodic listings of mortgage-delinquent properties are printed in the Daily Law Bulletin, which is available at newsstands, and in daily and community newspapers. Those interested in bidding on properties can also get a list in advance of scheduled sales from the auction companies and from the Cook County Sheriff`s Office in the Daley Center.

A list of properties can also be obtained from the real-estate-owned, or REO, divisions of some savings and loans and banks.

Other services, such as KaNia Foreclosure Enterprises in Downers Grove, list properties and background information on them for a fee. These listings include the name of the mortgage company, bank or private individual holding the delinquent note; the name of the borrower; the address of the property; the chancery court case number; the attorneys involved; the mortgage balance; and other notes and descriptions of the property.

Services such as KaNia do some of the homework for bidders, but they also charge a fee; KaNia`s fees range from $30 to $140, depending on the length of time a person has subscribed to the service.

Many who subscribe to these services are investors who make a living by buying and reselling mortgage-delinquent properties for a profit. But people interested in buying a home for themselves can also subscribe.

“Not everyone who comes (to the auction) is a shark,” said Andre Bowdry, who heads KaNia Foreclosure Enterprises and buys mortgage-delinquent properties. “Some people are here to buy homes to live in or to be used as an investment.” Buyers who do their homework can definitely come out ahead, he said.

Pointing to an address on a mortgage-delinquent property list, Bowdry said the single-family home, located in a middle-class South Side neighborhood, could get a bid of $38,000.

“Homes in this block could sell for $80,000,” he said. “Even if you have to put in $10,000 worth of work, you can come out ahead.” Informal affairs The Cook County Sheriff`s Office conducts auctions/sales at noon every Tuesday, Wednesday and Thursday in the seventh-floor hallway at the Daley Center.

These are very informal affairs, usually attended by 25 to 30 people.

Bidders come prepared with lists of the properties and make notes as the bidding progresses.

They also come with cash-a certified check for the full amount they plan to bid made payable to themselves. If the bid is accepted, the certified check is then signed over to the mortgage lender.

Experts keep repeating, however, that bidders should try to see the property before bidding on it.

Scott Bowers, vice president of the real estate division at the Dunning Auction Service of Elgin, says it`s a good idea to bring a home inspector with you to check out the property. Still, you may not be able to enter the house if delinquent homeowners are still living on the premises because they are not required by law to allow bidders onto the property, Bowers said. When this happens, potential buyers often don`t see the interior of the house until the borrower has been evicted by the lender.

“You`d be surprised how many people buy properties without seeing the inside,” Levine said. “No, it`s not wise, but it does happen. Some people are so anxious to get what they think is a deal, they buy without seeing the whole thing.” In addition to checking out the physical aspects of the house, Levine said, bidders should also examine the title to the property.

“This is not a job for novices,” said Levine. “An attorney should help you through the process.” He said it`s also important to obtain a title report on the property and to determine whether there are any liens or other mortgages on it.

Far and wide And while most people may think mortgage-delinquent properties are confined to poor neighborhoods, that`s not the case.

“The addresses are all over the place,” said Nasca. “Rich people get overextended, lose jobs, husbands and their houses like anybody else.” Properties sold at the sheriff`s auction last month included a house at 76th Street and Luella Avenue on Chicago`s South Side, which went for about $38,000; and a condo at 950 N. Michigan Ave., on which a $750,000 bid was made by an attorney representing the delinquent owner/borrower.

“For the most part, these things are attended by the same people, some individual investors, tax guys and lawyers,” said Levine. “Some people have made their living off buying and reselling these properties. The ones who do well at this are the ones who have been doing it for some time. You don`t just come in one day and get rich from buying a couple of these houses.” Investors in delinquent properties, like Bowdry of KaNia Foreclosure, say it`s possible to purchase mortgage-delinquent property before the public sale by contacting the REO department of the mortgage lender. If the lender is willing to share information about the property and sees that the bidder is serious about purchasing it, then the lender may be willing to negotiate a price and financing for the property.

The delinquent borrower/homeowner may also be willing to work out an arrangement with a buyer.

“The homeowners are skeptical in the beginning. They have a hard time coming to terms with what`s happening to them,” said Bowdry, who suggested offering homeowners a few thousand dollars more than what is owed on the property. “This way the homeowner doesn`t lose, the lender is paid and you can get a good buy on a piece of property to use as your own home or as an investment.”

Caption:

PHOTOS 2 GRAPHIC

Caption:

PHOTO: David Azran (far left) of Intercounty Judicial Sales Corp., auctions off a list of distressed properties. Tribune photo by Chris Walker.

PHOTO: A distressed condo in this building, at 950 N. Michigan Ave., went for $750,000 at the sheriff`s auction last month. Tribune photo by Val Mazzenga.

This Google Chrome extension simplifies the creation of real estate sales contracts, provides on-demand research tools, and calculates maximum allowable offers. It integrates with popular data portals and generates PDF contracts instantly.

iBuyAny.com (buying houses)

All the tools you need to grow in one place: Online Reviews, Messaging, Webchat, Payments, Missed Call Text Back, CRM

Andre Bowdry, principal at iBuyAny, LLC is a Licensed Real Estate Brokers (in the state of Illinois), and is a Real Estate Investor for over 30 years (Please note a 1991 Chicago Tribune newspaper article, “BARGAIN HUNTING”, that references our company, formally known as KaNia Enterprises).

(Chicago Tribune Article, transcript)

BARGAIN HUNTING

THERE ARE DEALS TO BE MADE ON DISTRESSED PROPERTIES,

BUT YOU`LL HAVE TO DO SOME LEGWORK

Pamela Sherrod.

Friday, August 2, 1991

Chicago Tribune

If you thought buying mortgage-delinquent property would be a sure-fire way to get rich quick, forget it.

Shopping for distressed properties has the same potential pitfalls as shopping for any kind of bargain: There are good deals to be had for little money, but you have to look for them-and should realize that you could be buying damaged goods.

Like most clearance-sale items, foreclosed property is sold “as is,” and it usually falls into one of two categories: “lemons” or “diamonds in the rough”.

Like the properties, the shoppers usually fall into one of two categories, too. They`re either individuals looking for a place to live for little money or investors looking for properties to resell quickly at a profit.

But some real estate professionals say the cost of repairs on these properties can eat up much of the profit these bargain hunters expect to make. “Even after doing your homework, you can still get stuck with something that will be too expensive to restore to livable standards or something you`ll have trouble unloading later,” said Harold Levine, a Chicago-based attorney who specializes in foreclosed properties.

Buying a house in the most ideal circumstances is risky enough, but purchasing a foreclosed home can be even riskier because the circumstances leading to the foreclosure are anything but ideal.

“When people fall behind on their mortgage, they fall behind in the upkeep of the house, too,” Levine said. “Homes that are not (being foreclosed upon) may need work, but the repairs needed in mortgage-delinquent properties are usually more extensive.” As a buyer interested in purchasing a foreclosed property, you should shop for a house in much the same way you would shop for any home. But you should also take the extra step of finding out as much as you can about the condition of the home and the neighborhood`s property values.

“The auction or sale itself goes by very quickly,” said Antoinette Nasca, office manager of the Intercounty Judicial Sales Corp., 120 W. Madison St., which conducts sales of distressed properties. “It lasts no more than 15 to 30 minutes.” The longest part of these purchases should come well before the auction, when potential bidders bone up on the available properties, she advised. “It`s best to make a bid based on what they feel the property is worth as is and the amount owed the lender.

“You really can`t afford to skimp on any part of this process before making the bid.” Do some snooping One of the first things to find out is how the property got to the sale in the first place.

Properties reach the rosters of distressed real estate sales when the homeowners are in arrears on mortgage payments and unable to work out new payment plans with mortgage lenders. Unemployment, divorce or the death of a spouse often leave homeowners financially strapped and facing foreclosure.

The foreclosure process can take nine months to a year to complete, and the sale or auction of the property represents the end of what is usually a long, bumpy road for the lender and the borrower.

In Cook County, mortgage-delinquent property comes up for public sale after a judgment of foreclosure is filed with the Chancery Division of Cook County Circuit Court. Under foreclosure law, there is a redemption period in which the property can be repurchased by the borrower. The length of the redemption period varies, depending on how long the borrower has held the property.

If the borrower is unable to buy back the property or reinstate the mortgage loan, the public sale takes place 90 days after the court makes a decree of foreclosure.

The lender then decides whether the sale of the property will be handled by the county sheriff`s office or by an independent auction company, such as Intercounty Judicial Sales Corp. or Dunning Auction Service of Elgin, which specialize in selling such real estate.

Getting your hands on lists Periodic listings of mortgage-delinquent properties are printed in the Daily Law Bulletin, which is available at newsstands, and in daily and community newspapers. Those interested in bidding on properties can also get a list in advance of scheduled sales from the auction companies and from the Cook County Sheriff`s Office in the Daley Center.

A list of properties can also be obtained from the real-estate-owned, or REO, divisions of some savings and loans and banks.

Other services, such as KaNia Foreclosure Enterprises in Downers Grove, list properties and background information on them for a fee. These listings include the name of the mortgage company, bank or private individual holding the delinquent note; the name of the borrower; the address of the property; the chancery court case number; the attorneys involved; the mortgage balance; and other notes and descriptions of the property.

Services such as KaNia do some of the homework for bidders, but they also charge a fee; KaNia`s fees range from $30 to $140, depending on the length of time a person has subscribed to the service.

Many who subscribe to these services are investors who make a living by buying and reselling mortgage-delinquent properties for a profit. But people interested in buying a home for themselves can also subscribe.

“Not everyone who comes (to the auction) is a shark,” said Andre Bowdry, who heads KaNia Foreclosure Enterprises and buys mortgage-delinquent properties. “Some people are here to buy homes to live in or to be used as an investment.” Buyers who do their homework can definitely come out ahead, he said.

Pointing to an address on a mortgage-delinquent property list, Bowdry said the single-family home, located in a middle-class South Side neighborhood, could get a bid of $38,000.

“Homes in this block could sell for $80,000,” he said. “Even if you have to put in $10,000 worth of work, you can come out ahead.” Informal affairs The Cook County Sheriff`s Office conducts auctions/sales at noon every Tuesday, Wednesday and Thursday in the seventh-floor hallway at the Daley Center.

These are very informal affairs, usually attended by 25 to 30 people.

Bidders come prepared with lists of the properties and make notes as the bidding progresses.

They also come with cash-a certified check for the full amount they plan to bid made payable to themselves. If the bid is accepted, the certified check is then signed over to the mortgage lender.

Experts keep repeating, however, that bidders should try to see the property before bidding on it.

Scott Bowers, vice president of the real estate division at the Dunning Auction Service of Elgin, says it`s a good idea to bring a home inspector with you to check out the property. Still, you may not be able to enter the house if delinquent homeowners are still living on the premises because they are not required by law to allow bidders onto the property, Bowers said. When this happens, potential buyers often don`t see the interior of the house until the borrower has been evicted by the lender.

“You`d be surprised how many people buy properties without seeing the inside,” Levine said. “No, it`s not wise, but it does happen. Some people are so anxious to get what they think is a deal, they buy without seeing the whole thing.” In addition to checking out the physical aspects of the house, Levine said, bidders should also examine the title to the property.

“This is not a job for novices,” said Levine. “An attorney should help you through the process.” He said it`s also important to obtain a title report on the property and to determine whether there are any liens or other mortgages on it.

Far and wide And while most people may think mortgage-delinquent properties are confined to poor neighborhoods, that`s not the case.

“The addresses are all over the place,” said Nasca. “Rich people get overextended, lose jobs, husbands and their houses like anybody else.” Properties sold at the sheriff`s auction last month included a house at 76th Street and Luella Avenue on Chicago`s South Side, which went for about $38,000; and a condo at 950 N. Michigan Ave., on which a $750,000 bid was made by an attorney representing the delinquent owner/borrower.

“For the most part, these things are attended by the same people, some individual investors, tax guys and lawyers,” said Levine. “Some people have made their living off buying and reselling these properties. The ones who do well at this are the ones who have been doing it for some time. You don`t just come in one day and get rich from buying a couple of these houses.” Investors in delinquent properties, like Bowdry of KaNia Foreclosure, say it`s possible to purchase mortgage-delinquent property before the public sale by contacting the REO department of the mortgage lender. If the lender is willing to share information about the property and sees that the bidder is serious about purchasing it, then the lender may be willing to negotiate a price and financing for the property.

The delinquent borrower/homeowner may also be willing to work out an arrangement with a buyer.

“The homeowners are skeptical in the beginning. They have a hard time coming to terms with what`s happening to them,” said Bowdry, who suggested offering homeowners a few thousand dollars more than what is owed on the property. “This way the homeowner doesn`t lose, the lender is paid and you can get a good buy on a piece of property to use as your own home or as an investment.”

Caption:

PHOTOS 2 GRAPHIC

Caption:

PHOTO: David Azran (far left) of Intercounty Judicial Sales Corp., auctions off a list of distressed properties. Tribune photo by Chris Walker.

PHOTO: A distressed condo in this building, at 950 N. Michigan Ave., went for $750,000 at the sheriff`s auction last month. Tribune photo by Val Mazzenga.

This Google Chrome extension simplifies the creation of real estate sales contracts, provides on-demand research tools, and calculates maximum allowable offers. It integrates with popular data portals and generates PDF contracts instantly.

iBuyAny.com (buying houses)

All the tools you need to grow in one place: Online Reviews, Messaging, Webchat, Payments, Missed Call Text Back, CRM

Andre Bowdry, principal at iBuyAny, LLC is a Licensed Real Estate Brokers (in the state of Illinois), and is a Real Estate Investor for over 30 years (Please note a 1991 Chicago Tribune newspaper article, “BARGAIN HUNTING”, that references our company, formally known as KaNia Enterprises).

(Chicago Tribune Article, transcript)

BARGAIN HUNTING

THERE ARE DEALS TO BE MADE ON DISTRESSED PROPERTIES,

BUT YOU`LL HAVE TO DO SOME LEGWORK

Pamela Sherrod.

Friday, August 2, 1991

Chicago Tribune

If you thought buying mortgage-delinquent property would be a sure-fire way to get rich quick, forget it.

Shopping for distressed properties has the same potential pitfalls as shopping for any kind of bargain: There are good deals to be had for little money, but you have to look for them-and should realize that you could be buying damaged goods.

Like most clearance-sale items, foreclosed property is sold “as is,” and it usually falls into one of two categories: “lemons” or “diamonds in the rough”.

Like the properties, the shoppers usually fall into one of two categories, too. They`re either individuals looking for a place to live for little money or investors looking for properties to resell quickly at a profit.

But some real estate professionals say the cost of repairs on these properties can eat up much of the profit these bargain hunters expect to make. “Even after doing your homework, you can still get stuck with something that will be too expensive to restore to livable standards or something you`ll have trouble unloading later,” said Harold Levine, a Chicago-based attorney who specializes in foreclosed properties.

Buying a house in the most ideal circumstances is risky enough, but purchasing a foreclosed home can be even riskier because the circumstances leading to the foreclosure are anything but ideal.

“When people fall behind on their mortgage, they fall behind in the upkeep of the house, too,” Levine said. “Homes that are not (being foreclosed upon) may need work, but the repairs needed in mortgage-delinquent properties are usually more extensive.” As a buyer interested in purchasing a foreclosed property, you should shop for a house in much the same way you would shop for any home. But you should also take the extra step of finding out as much as you can about the condition of the home and the neighborhood`s property values.

“The auction or sale itself goes by very quickly,” said Antoinette Nasca, office manager of the Intercounty Judicial Sales Corp., 120 W. Madison St., which conducts sales of distressed properties. “It lasts no more than 15 to 30 minutes.” The longest part of these purchases should come well before the auction, when potential bidders bone up on the available properties, she advised. “It`s best to make a bid based on what they feel the property is worth as is and the amount owed the lender.

“You really can`t afford to skimp on any part of this process before making the bid.” Do some snooping One of the first things to find out is how the property got to the sale in the first place.

Properties reach the rosters of distressed real estate sales when the homeowners are in arrears on mortgage payments and unable to work out new payment plans with mortgage lenders. Unemployment, divorce or the death of a spouse often leave homeowners financially strapped and facing foreclosure.

The foreclosure process can take nine months to a year to complete, and the sale or auction of the property represents the end of what is usually a long, bumpy road for the lender and the borrower.

In Cook County, mortgage-delinquent property comes up for public sale after a judgment of foreclosure is filed with the Chancery Division of Cook County Circuit Court. Under foreclosure law, there is a redemption period in which the property can be repurchased by the borrower. The length of the redemption period varies, depending on how long the borrower has held the property.

If the borrower is unable to buy back the property or reinstate the mortgage loan, the public sale takes place 90 days after the court makes a decree of foreclosure.

The lender then decides whether the sale of the property will be handled by the county sheriff`s office or by an independent auction company, such as Intercounty Judicial Sales Corp. or Dunning Auction Service of Elgin, which specialize in selling such real estate.

Getting your hands on lists Periodic listings of mortgage-delinquent properties are printed in the Daily Law Bulletin, which is available at newsstands, and in daily and community newspapers. Those interested in bidding on properties can also get a list in advance of scheduled sales from the auction companies and from the Cook County Sheriff`s Office in the Daley Center.

A list of properties can also be obtained from the real-estate-owned, or REO, divisions of some savings and loans and banks.

Other services, such as KaNia Foreclosure Enterprises in Downers Grove, list properties and background information on them for a fee. These listings include the name of the mortgage company, bank or private individual holding the delinquent note; the name of the borrower; the address of the property; the chancery court case number; the attorneys involved; the mortgage balance; and other notes and descriptions of the property.

Services such as KaNia do some of the homework for bidders, but they also charge a fee; KaNia`s fees range from $30 to $140, depending on the length of time a person has subscribed to the service.

Many who subscribe to these services are investors who make a living by buying and reselling mortgage-delinquent properties for a profit. But people interested in buying a home for themselves can also subscribe.

“Not everyone who comes (to the auction) is a shark,” said Andre Bowdry, who heads KaNia Foreclosure Enterprises and buys mortgage-delinquent properties. “Some people are here to buy homes to live in or to be used as an investment.” Buyers who do their homework can definitely come out ahead, he said.

Pointing to an address on a mortgage-delinquent property list, Bowdry said the single-family home, located in a middle-class South Side neighborhood, could get a bid of $38,000.

“Homes in this block could sell for $80,000,” he said. “Even if you have to put in $10,000 worth of work, you can come out ahead.” Informal affairs The Cook County Sheriff`s Office conducts auctions/sales at noon every Tuesday, Wednesday and Thursday in the seventh-floor hallway at the Daley Center.

These are very informal affairs, usually attended by 25 to 30 people.

Bidders come prepared with lists of the properties and make notes as the bidding progresses.

They also come with cash-a certified check for the full amount they plan to bid made payable to themselves. If the bid is accepted, the certified check is then signed over to the mortgage lender.

Experts keep repeating, however, that bidders should try to see the property before bidding on it.

Scott Bowers, vice president of the real estate division at the Dunning Auction Service of Elgin, says it`s a good idea to bring a home inspector with you to check out the property. Still, you may not be able to enter the house if delinquent homeowners are still living on the premises because they are not required by law to allow bidders onto the property, Bowers said. When this happens, potential buyers often don`t see the interior of the house until the borrower has been evicted by the lender.

“You`d be surprised how many people buy properties without seeing the inside,” Levine said. “No, it`s not wise, but it does happen. Some people are so anxious to get what they think is a deal, they buy without seeing the whole thing.” In addition to checking out the physical aspects of the house, Levine said, bidders should also examine the title to the property.

“This is not a job for novices,” said Levine. “An attorney should help you through the process.” He said it`s also important to obtain a title report on the property and to determine whether there are any liens or other mortgages on it.

Far and wide And while most people may think mortgage-delinquent properties are confined to poor neighborhoods, that`s not the case.

“The addresses are all over the place,” said Nasca. “Rich people get overextended, lose jobs, husbands and their houses like anybody else.” Properties sold at the sheriff`s auction last month included a house at 76th Street and Luella Avenue on Chicago`s South Side, which went for about $38,000; and a condo at 950 N. Michigan Ave., on which a $750,000 bid was made by an attorney representing the delinquent owner/borrower.

“For the most part, these things are attended by the same people, some individual investors, tax guys and lawyers,” said Levine. “Some people have made their living off buying and reselling these properties. The ones who do well at this are the ones who have been doing it for some time. You don`t just come in one day and get rich from buying a couple of these houses.” Investors in delinquent properties, like Bowdry of KaNia Foreclosure, say it`s possible to purchase mortgage-delinquent property before the public sale by contacting the REO department of the mortgage lender. If the lender is willing to share information about the property and sees that the bidder is serious about purchasing it, then the lender may be willing to negotiate a price and financing for the property.

The delinquent borrower/homeowner may also be willing to work out an arrangement with a buyer.

“The homeowners are skeptical in the beginning. They have a hard time coming to terms with what`s happening to them,” said Bowdry, who suggested offering homeowners a few thousand dollars more than what is owed on the property. “This way the homeowner doesn`t lose, the lender is paid and you can get a good buy on a piece of property to use as your own home or as an investment.”

Caption:

PHOTOS 2 GRAPHIC

Caption:

PHOTO: David Azran (far left) of Intercounty Judicial Sales Corp., auctions off a list of distressed properties. Tribune photo by Chris Walker.

PHOTO: A distressed condo in this building, at 950 N. Michigan Ave., went for $750,000 at the sheriff`s auction last month. Tribune photo by Val Mazzenga.